Nota Fiscal Gaúcha-NFG Oficial

Description of Nota Fiscal Gaúcha-NFG Oficial

Nota Fiscal Gaúcha, commonly referred to as NFG, is a civic engagement application developed for the Android platform. This app facilitates the participation of citizens in the Nota Fiscal Gaúcha program, which aims to encourage individuals in the State of Rio Grande do Sul to request tax documents during their purchases. Users can download Nota Fiscal Gaúcha to actively engage in a system that promotes accountability in tax collection and supports charitable initiatives.

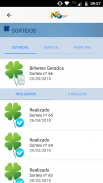

The primary function of the app is to provide a user-friendly interface for managing and tracking tax documents, known as notas fiscais. Users can easily input and store their purchase receipts, which are essential for participating in the program's prize draws. This functionality allows users to maintain an organized record of their transactions, making it simpler to verify their eligibility for rewards and understand their contributions to local tax revenues.

A key aspect of Nota Fiscal Gaúcha is its integration with the state's tax authority, enabling users to access real-time information regarding their tax documents. The app automatically updates users on any changes related to their entries, ensuring that they remain informed about their participation status. This direct link to the tax authority enhances transparency and fosters trust in the program.

The app also features a rewards system that incentivizes users to engage more actively with the Nota Fiscal Gaúcha initiative. Participants can earn points for every valid tax document they register within the app. These points can then be exchanged for chances to win prizes, which are periodically announced. This gamification element not only encourages more users to request tax documents but also promotes awareness about the importance of tax compliance.

In addition to the rewards program, Nota Fiscal Gaúcha allows users to donate their points to selected charities. This feature emphasizes community support and social responsibility, as users can contribute to local causes simply by participating in the app's tax-related activities. The ability to give back to the community makes the app not only a tool for individual benefit but also a platform for collective good.

User engagement is further enhanced through notifications and alerts provided by the app. Users receive reminders about upcoming prize draws, changes in rules, or new charitable initiatives. These notifications ensure that users are aware of all opportunities available to them, helping to maximize their involvement in the program.

The design of Nota Fiscal Gaúcha prioritizes usability, making it accessible for a wide range of users. The interface is straightforward, with clearly labeled sections that guide users through the process of entering their receipts, checking their points, and exploring charitable options. This intuitive layout is particularly beneficial for individuals who may not be technologically savvy, ensuring that everyone can take part in the program without difficulty.

For those interested in tracking their contributions, the app provides insightful analytics regarding users' tax document submissions and accumulated points. This feature allows users to see their impact on local tax revenues and understand how their participation contributes to the community. By highlighting these statistics, the app fosters a sense of accomplishment and encourages continued engagement.

Nota Fiscal Gaúcha also emphasizes security and privacy. Users can trust that their personal information and transaction details are protected within the app. The security measures in place are designed to safeguard users' data, allowing them to participate in the program without concerns about data breaches or misuse of their information.

Moreover, the app is regularly updated to ensure compliance with any changes in tax regulations and to improve user experience based on feedback. These updates may include new features, bug fixes, or enhancements that streamline the user journey. Such commitment to ongoing improvement reflects the developers' dedication to providing a reliable tool for citizens of Rio Grande do Sul.

Incorporating social elements, Nota Fiscal Gaúcha encourages users to share their experiences on social media platforms. This feature not only promotes the app itself but also raises awareness about the importance of tax compliance and community engagement. Users can easily share their success stories or invite friends to join the program, further expanding its reach and impact.

The app fosters a sense of community among its users as they collectively contribute to enhancing the transparency of tax collection in the region. Participants are not only consumers but also active members of a civic initiative that aims to improve local governance and support charitable endeavors.

Nota Fiscal Gaúcha serves as a practical tool for individuals in Rio Grande do Sul, blending user engagement with social responsibility and civic duty. By facilitating the management of tax documents and promoting charitable contributions, the app stands as a significant resource for fostering a culture of accountability and community support in the state.

For more details about the Nota Fiscal Gaúcha program, visit https://nfg.sefaz.rs.gov.br/site/institucional_o_que_e.aspx.